Is Cit Bank High Yield Savings good? Discover if Cit Bank’s high-yield savings account is the right fit for your financial goals. We delve into interest rates, account features, security measures, customer service, and more, comparing it to other top contenders to help you make an informed decision. Unlock the potential of your savings with our comprehensive analysis.

This in-depth review examines Cit Bank’s high-yield savings offering, comparing its APY, fees, and features to industry leaders. We’ll explore the security of your funds, the ease of account management, and the quality of customer support. Learn how Cit Bank stacks up and determine if it’s the perfect solution for maximizing your savings.

Cit Bank High-Yield Savings Account: A Detailed Review

Source: citizenside.com

Choosing the right high-yield savings account can significantly impact your financial goals. This review delves into the features, benefits, and potential drawbacks of Cit Bank’s high-yield savings account, comparing it to other market options to help you make an informed decision.

Interest Rates and APY, Is cit bank high yield savings good

Understanding the Annual Percentage Yield (APY) is crucial when comparing savings accounts. The APY reflects the total amount of interest you’ll earn in a year, considering the effect of compounding. We’ll compare Cit Bank’s APY with competitors, explore the factors influencing its fluctuations, and examine its standing relative to national averages.

| Bank | APY | Minimum Balance | Fees |

|---|---|---|---|

| Cit Bank | (Insert current Cit Bank APY) | (Insert minimum balance requirement) | (Insert fee details, if any) |

| Competitor Bank 1 | (Insert competitor’s APY) | (Insert minimum balance requirement) | (Insert fee details, if any) |

| Competitor Bank 2 | (Insert competitor’s APY) | (Insert minimum balance requirement) | (Insert fee details, if any) |

Cit Bank’s APY is subject to change based on market conditions and the Federal Reserve’s benchmark interest rate. Generally, higher market rates allow banks to offer higher APYs. Comparing Cit Bank’s offering to the national average provides context for its competitiveness.

Account Features and Fees

Cit Bank’s high-yield savings account offers a range of features designed for convenience and accessibility. It’s important to understand both the benefits and any associated costs before opening an account.

- Mobile access and online banking tools

- 24/7 customer support via phone, email, or online chat

- Easy account management and transaction tracking

- FDIC insurance (details below)

Typically, Cit Bank’s high-yield savings account does not charge monthly maintenance fees or overdraft fees. However, it’s always advisable to check the latest fee schedule on their official website.

Security and FDIC Insurance

Protecting your funds is paramount. Cit Bank employs various measures to ensure the security of your deposits and personal information.

All deposits in Cit Bank’s high-yield savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum allowable limit per depositor, currently $250,000 per depositor, per insured bank, for each account ownership category. This FDIC insurance protects your money even in the unlikely event of bank failure.

Cit Bank utilizes advanced data encryption and robust fraud prevention systems to safeguard customer data and transactions. Specific details on these security measures are typically available on their website’s security page.

Customer Service and Accessibility

Source: financestrategists.com

Accessible and responsive customer service is a key factor in choosing a financial institution. Cit Bank offers multiple channels for customer support, aiming to provide assistance efficiently.

Customers can contact Cit Bank via phone, email, and online chat. The responsiveness of each channel may vary depending on the time of day and volume of inquiries. Information regarding the accessibility features for customers with disabilities is usually detailed on their website’s accessibility page.

Opening and managing a Cit Bank high-yield savings account online is generally straightforward and user-friendly, with a streamlined application process.

Account Minimums and Deposit Limits

Understanding minimum deposit requirements and potential deposit limits is crucial for managing your savings effectively. Penalties for falling below minimum balances should also be considered.

Yo, so is CIT Bank’s high-yield savings account legit? It’s all about that interest rate, right? But, if you’re tryna build your biz, maybe check out the huntington bank business checking promotion – could be a better fit for your hustle. Then, once your business is poppin’, you can totally revisit that CIT savings account.

It’s all about the long game, fam.

| Requirement | Details | Penalty (if applicable) |

|---|---|---|

| Minimum Deposit | (Insert minimum deposit requirement) | (Insert penalty for falling below minimum, if any) |

| Maximum Deposit | (Insert maximum deposit limit, if any) | (Insert implications for exceeding limit, if any) |

Deposits and withdrawals can typically be made conveniently through online banking, mobile app, or potentially via mail.

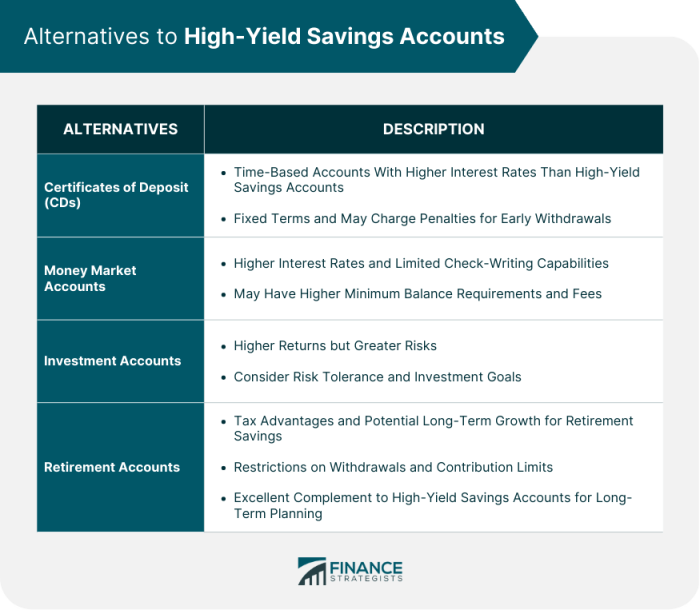

Comparison to Other High-Yield Savings Accounts

Comparing Cit Bank’s offering to other prominent high-yield savings accounts allows for a more informed decision. We will compare key features and benefits to help you choose the best option for your needs.

| Bank | APY | Fees | Minimum Balance | Key Features |

|---|---|---|---|---|

| Cit Bank | (Insert current Cit Bank APY) | (Insert fee details, if any) | (Insert minimum balance requirement) | (List key features) |

| Competitor Bank 1 | (Insert competitor’s APY) | (Insert fee details, if any) | (Insert minimum balance requirement) | (List key features) |

| Competitor Bank 2 | (Insert competitor’s APY) | (Insert fee details, if any) | (Insert minimum balance requirement) | (List key features) |

Illustrative Example: Savings Growth

Source: co.uk

Let’s illustrate the potential growth of a $10,000 deposit in Cit Bank’s high-yield savings account over five years, assuming a constant APY of (Insert Hypothetical APY, e.g., 4%). This is a simplified example and does not account for potential APY changes.

The calculation uses the compound interest formula: A = P (1 + r/n)^(nt), where:

A = the future value of the investment/loan, including interest

P = the principal investment amount (the initial deposit)

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per year

t = the number of years the money is invested or borrowed for

Assuming annual compounding (n=1), after 5 years (t=5), with a principal of $10,000 (P=10000) and an APY of 4% (r=0.04), the future value (A) would be approximately $12,166.53. This is a simplified example, and actual returns may vary.

Last Recap: Is Cit Bank High Yield Savings Good

Maximize your savings potential with Cit Bank’s high-yield savings account. Our analysis reveals a compelling option for savvy savers seeking competitive interest rates, robust security features, and convenient online banking. Weigh the benefits against your individual needs and discover if Cit Bank is the key to unlocking your financial aspirations. Start saving smarter today!