Can you create a td bank account online – Can you create a TD Bank account online? Duh,

-teuing*! Turns out, it’s easier than ordering

-mie ayam* on GoFood. This ain’t your

-emak’s* bank anymore; we’re talking slick online applications, faster than you can say “gokil!” We’ll break down the whole process, from start to finish, so you can ditch the line at the branch and chill at home.

Think of it as a digital

-ngabuburit*, but instead of

-kuih*, you get a shiny new bank account.

We’ll walk you through each step, showing you exactly what you need, what to expect, and how to avoid any

-ributan*. We’ll even spill the tea on the different account types, security measures (because your money’s important,

-duh*), and troubleshooting those pesky errors. So grab your laptop, a cup of

-teh manis*, and let’s get this show on the road!

Opening a TD Bank Account Online

Opening a TD Bank account online offers convenience and efficiency. This guide details the process, available account types, required documentation, security measures, troubleshooting tips, post-application procedures, and a comparison with in-person account opening. We also address accessibility features for users with disabilities.

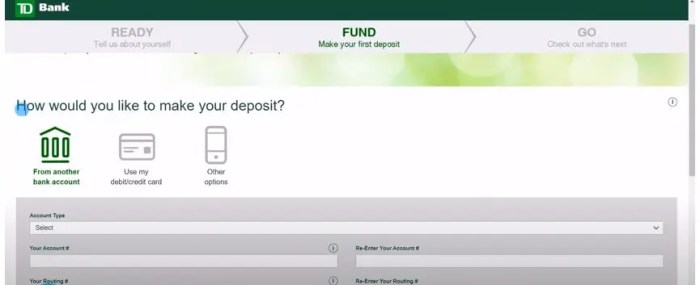

TD Bank Account Online Application Process

The online application process for a TD Bank account is straightforward. The following steps Artikel the procedure, along with the information required at each stage.

Yes, you can easily create a TD Bank account online, streamlining your financial management. For those seeking long-term growth, consider exploring options like a fixed term IRA Bank of America , which offers a structured savings approach. Returning to TD Bank, remember that online account creation provides convenience and control over your finances, empowering you to reach your financial goals.

- Visit the TD Bank Website: Navigate to the official TD Bank website and locate the “Open an Account” section. A prominent button or link usually directs you to the application page. The website’s homepage typically features clear visuals guiding users to this section.

- Select Account Type: Choose the account type that best suits your needs from the available options. The website provides descriptions of each account type, allowing for informed decision-making. A dropdown menu or a series of clickable account type icons are commonly used for this step.

- Provide Personal Information: Enter your personal details, including your name, address, date of birth, and Social Security number. The application form clearly labels each field for accurate data entry. Error messages appear if information is missing or incorrectly formatted.

- Create Login Credentials: Choose a secure username and password for your online banking account. The website usually provides guidelines for creating a strong password, ensuring account security. Password complexity requirements are clearly displayed.

- Verify Identity: You will be prompted to verify your identity through methods such as answering security questions or providing additional information. The verification process ensures that only authorized individuals can access and manage the account. A multi-step verification process is implemented for enhanced security.

- Review and Submit Application: Carefully review all the entered information before submitting your application. The website provides a summary of your application for final confirmation before submission. A clear “Submit” button is usually prominent on the review page.

| Step | Action | Required Information | Notes |

|---|---|---|---|

| 1 | Visit the TD Bank Website | None | Navigate to the official TD Bank website and find the “Open an Account” section. |

| 2 | Select Account Type | Desired account type | Review account descriptions to make an informed decision. |

| 3 | Provide Personal Information | Name, Address, Date of Birth, SSN, etc. | Ensure accuracy; error messages will guide corrections. |

| 4 | Create Login Credentials | Username, Password | Follow password complexity guidelines for enhanced security. |

| 5 | Verify Identity | Security answers or additional information | This step ensures account security. |

| 6 | Review and Submit Application | Review all entered information | Confirm accuracy before submission. |

Account Types Available Online

TD Bank offers various account types that can be opened online. Each account type caters to different needs and financial goals. The following table compares three common account types.

- Checking Accounts: These accounts provide convenient access to funds, typically with debit card access and online banking capabilities.

- Savings Accounts: Designed for accumulating savings, these accounts often offer interest but may have limited transaction capabilities.

- Money Market Accounts: These accounts offer higher interest rates than standard savings accounts but may have minimum balance requirements.

| Account Type | Features | Benefits | Fees |

|---|---|---|---|

| Checking Account | Debit card, online banking, bill pay | Convenient access to funds, easy transaction management | May vary; check for monthly maintenance fees or transaction limits. |

| Savings Account | Interest earning, online access | Safe place for savings, interest accrual | May vary; some accounts may have minimum balance requirements. |

| Money Market Account | Higher interest rates, check-writing privileges (sometimes) | Higher returns on savings | Potentially higher minimum balance requirements, possible fees for exceeding transaction limits. |

Required Documentation for Online Application

To successfully open a TD Bank account online, you will need specific documentation to verify your identity and address. The following list Artikels the necessary documents and acceptable formats.

- Government-issued photo ID (Driver’s License, Passport): .jpg, .png, .pdf

- Social Security Number (SSN): Required for verification purposes. Not uploaded as a document, but entered directly into the application.

- Proof of Address (Utility bill, bank statement): .jpg, .png, .pdf

Security Measures During Online Application, Can you create a td bank account online

TD Bank employs robust security measures to protect customer information during the online account opening process. This includes encryption, multi-factor authentication, and fraud detection systems.

Identity verification involves several steps, including confirming the information provided against various databases and potentially requesting additional documentation for verification.

A flowchart illustrating the security verification steps would include: Data entry -> Initial validation -> Identity verification (SSN, Address) -> Document upload and verification -> Multi-factor authentication (if applicable) -> Account creation.

Troubleshooting Common Online Application Issues

Common issues during online account application include incorrect information, technical glitches, and identity verification problems. The following table provides solutions for these issues.

| Problem | Cause | Solution | Additional Notes |

|---|---|---|---|

| Application Error Message | Incorrect information entry | Review and correct the information. | Pay close attention to error messages for guidance. |

| Website Technical Issues | Server issues, browser compatibility | Try again later or use a different browser. | Contact TD Bank customer support if the problem persists. |

| Identity Verification Failure | Incorrect information, missing documentation | Ensure information is accurate; provide requested documentation. | Contact TD Bank customer support if you continue to experience issues. |

Post-Application Procedures

Source: walletbliss.com

After submitting your application, you’ll receive confirmation, instructions for account activation, and details on accessing online banking.

- Account confirmation email: within 24-48 hours (typical timeframe).

- Account activation: Follow instructions in the confirmation email.

- Initial login: Use your created credentials to access your online banking account.

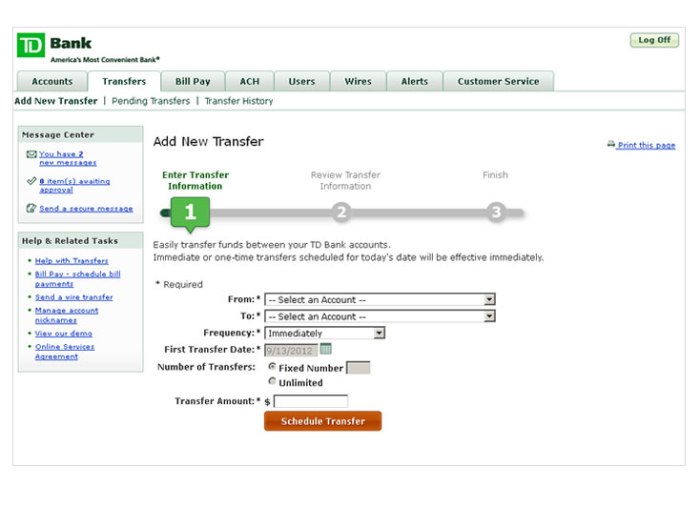

Comparison with In-Person Account Opening

Opening a TD Bank account online offers convenience and speed, while in-person application allows for immediate assistance and clarification of any questions.

| Feature | Online Application | In-Person Application | Advantages/Disadvantages |

|---|---|---|---|

| Convenience | High; can be done anytime, anywhere. | Low; requires travel to a branch during business hours. | Online: Convenient; In-person: Requires time and travel. |

| Speed | Fast; application and approval can be quick. | Slower; involves waiting time and paperwork processing. | Online: Faster; In-person: Slower processing. |

| Personal Assistance | Limited; online help resources available. | High; bank staff provides immediate support. | Online: Less personal assistance; In-person: Direct assistance available. |

Accessibility Features for Online Application

Source: thesmartinvestor.com

TD Bank’s online application process incorporates accessibility features to cater to users with disabilities. These features include screen reader compatibility, keyboard navigation, and adjustable text size.

Screen reader compatibility ensures that visually impaired users can access and navigate the application using screen reading software. Keyboard navigation allows users with motor impairments to control the application using only the keyboard. Adjustable text size enables users to customize the font size for improved readability.

Last Word: Can You Create A Td Bank Account Online

Source: tdbank.com

So there you have it, folks! Opening a TD Bank account online is totally doable, even for a

-jaman now* tech-challenged person like your

-teteh*. It’s quick, convenient, and honestly, way less stressful than battling traffic to get to a branch. Remember to keep your documents handy, double-check everything, and don’t hesitate to reach out if you hit a snag.

Now go forth and conquer your online banking journey!

-Maju terus pantang mundur!*