Cit bank open savings account – Citibank open savings account? Yo, it’s way easier than you think! Forget those stuffy bank lines; we’re talking smooth online access, killer mobile app features, and sweet interest rates. This isn’t your grandpa’s savings account – we’re diving deep into how to open one, manage it like a boss, and score all the perks. Get ready to level up your financial game, Surabaya style.

Whether you’re saving for that next epic adventure, a new gadget, or just building a solid financial foundation, understanding how to open and manage a Citibank savings account is key. We’ll break down the steps, compare it to other banks, and even show you how to handle everything from your phone. Think of this as your ultimate guide to adulting – Surabaya edition.

Opening a Citibank Online Savings Account: A Seamless Experience

Opening a savings account with Citibank is a straightforward process, offering both online and in-person options to cater to your convenience. This guide provides a comprehensive overview of the account opening process, features, security measures, and customer support available. Whether you’re tech-savvy and prefer the speed of online banking or prefer the personal touch of in-person interaction, Citibank offers a solution tailored to your needs.

Citibank Online Savings Account Opening Process

Opening a Citibank online savings account is quick and easy. The process involves several key steps, from providing personal information to verifying your identity. You can choose between an individual or joint account, depending on your preference.

- Visit the Citibank website and locate the “Open an Account” section.

- Select the “Savings Account” option and choose between individual or joint account.

- Fill out the online application form, providing accurate personal information, including your full name, address, date of birth, and Social Security number (or equivalent).

- Upload the required identification documents, such as a government-issued ID and proof of address.

- Review and confirm your application details.

- Once your application is approved, you’ll receive confirmation and access details for your new account.

Required documentation typically includes a government-issued photo ID (passport, driver’s license) and proof of address (utility bill, bank statement).

Mobile App Account Creation

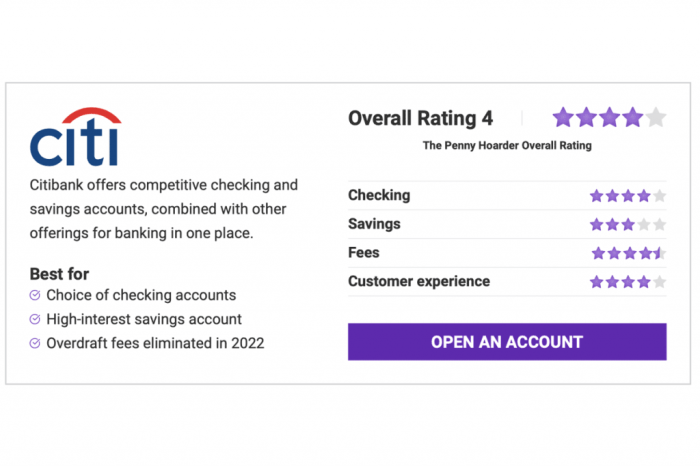

Source: thepennyhoarder.com

Creating a Citibank savings account through the mobile app mirrors the online process. The app offers a user-friendly interface, guiding you through each step with clear instructions and visual cues.

- Download the Citi Mobile app from your app store.

- Tap on the “Open an Account” option.

- Select “Savings Account” and choose the account type.

- Provide the necessary personal information and upload required documents.

- Verify your identity through the app’s security features.

- Review and confirm your application details.

Online vs. In-Person Account Opening

| Feature | Online Account Opening | In-Person Account Opening |

|---|---|---|

| Convenience | High, available 24/7 | Moderate, requires visiting a branch |

| Speed | Fast, typically completed within minutes | Slower, may involve waiting times |

| Personal Assistance | Limited | High, allows direct interaction with a representative |

| Required Documents | Uploaded electronically | Submitted physically at the branch |

Citibank Savings Account Features and Benefits

Citibank savings accounts offer a range of features designed to make managing your finances easier and more rewarding. These features, combined with competitive interest rates and robust security measures, make Citibank a compelling choice for your savings needs.

Interest Rates and Transaction Limits

Citibank offers competitive interest rates on its savings accounts, although the exact rate may vary depending on the account type and balance. Transaction limits and fees are clearly Artikeld in the account terms and conditions. Contact Citibank directly for the most current interest rate information.

Online Banking and Mobile App Access

Source: gromo.in

Citibank provides secure online banking and mobile app access, allowing you to manage your account anytime, anywhere. Features include account balance checks, fund transfers, bill payments, and account statement downloads. The mobile app is designed for intuitive navigation and ease of use.

Key Advantages of a Citibank Savings Account, Cit bank open savings account

- Competitive interest rates

- Convenient online and mobile banking access

- Robust security measures to protect your funds

- Excellent customer service and support

- Variety of account options to suit individual needs

Citibank Savings Account Management and Security

Citibank prioritizes the security and ease of management of your savings account. Multiple methods are available for accessing and managing your account, and robust security measures are in place to protect your financial information.

Opening a CIT Bank savings account offers competitive interest rates and robust online banking features. To understand the institution’s stability and track record, it’s helpful to know its history; discovering just how long has CIT Bank been around provides valuable context. This historical perspective informs the confidence one can place in the bank’s long-term financial health, a key factor when choosing where to place your savings.

Account Management and Security Measures

Managing your account settings and preferences is simple through online banking or the mobile app. Citibank employs advanced security measures, including encryption and fraud monitoring, to protect your account from unauthorized access. Multi-factor authentication adds an extra layer of security.

Accessing and Managing Your Citibank Savings Account

| Method | Description |

|---|---|

| Online Banking | Access your account through the Citibank website. |

| Mobile App | Manage your account using the Citi Mobile app. |

| Phone Banking | Contact Citibank customer service via phone. |

| In-Person at a Branch | Visit a Citibank branch for assistance. |

Citibank Customer Service and Support

Citibank offers various customer service channels to assist you with any account-related inquiries or issues. Whether you prefer phone, email, or online chat, Citibank strives to provide prompt and efficient support.

Customer Service Channels and Resources

Contact Citibank customer service through phone, email, or online chat. Detailed contact information is available on the Citibank website. For account disputes, follow the dispute resolution process Artikeld in your account agreement.

Frequently Asked Questions (FAQs)

- What are the minimum deposit requirements? This varies depending on the specific account type; check the Citibank website for details.

- How do I transfer funds to another account? Transfers can be initiated through online banking or the mobile app.

- What are the fees associated with my account? Fee details are Artikeld in the account agreement.

- How do I request an account statement? Statements can be accessed and downloaded through online banking.

- What happens if my debit card is lost or stolen? Report it immediately to Citibank customer service.

A Day in the Life of a Citibank Savings Account User: Cit Bank Open Savings Account

Imagine Sarah, a busy professional who relies on her Citibank online savings account for daily financial management. She starts her day by checking her account balance on the Citi Mobile app, noting the interest earned overnight. Later, she uses the app to transfer funds to pay a bill. In the evening, she reviews her transactions and downloads a statement for her records.

The seamless integration of online and mobile banking allows Sarah to manage her finances efficiently and effortlessly, even amidst her busy schedule. The clean, intuitive interface of the app, combined with the security features, gives her peace of mind knowing her savings are safe and accessible whenever she needs them.

Summary

So there you have it – opening a Citibank savings account isn’t some impossible mission. With its user-friendly online platform, rock-solid security, and awesome customer support, it’s a total game-changer. From managing your funds to securing your future, Citibank’s got you covered. Now go forth, conquer your savings goals, and treat yourself to something nice – you deserve it!